St Kitts and Nevis Citizenship by Investment Program (CBI) is the oldest and trusted program established since 1984, offering citizenship to investors who contribute one time investment to SIDF ($250,000) or HRF ($150,000) or in a real estate project ($400,000).

On July 2017, IMF published 2017 Article IV Consultation with St. Kitts and Nevis. Here are some of the important points mentioned in the report.

- The St Kitts and Nevis economy grew at 3.2 percent in 2016, compared to 4.9 percent in 2015

- Growth is expected to average around 3 percent in the medium term under the current policies and conservative assumptions about future CBI flows.

- St. Kitts and Nevis is the fourth major stayover tourist destination among ECCU countries, with around 60 percent of its visitors arriving from the U.S., 6 percent from Canada, 8 percent from UK, and 20 percent from other Caribbean countries.

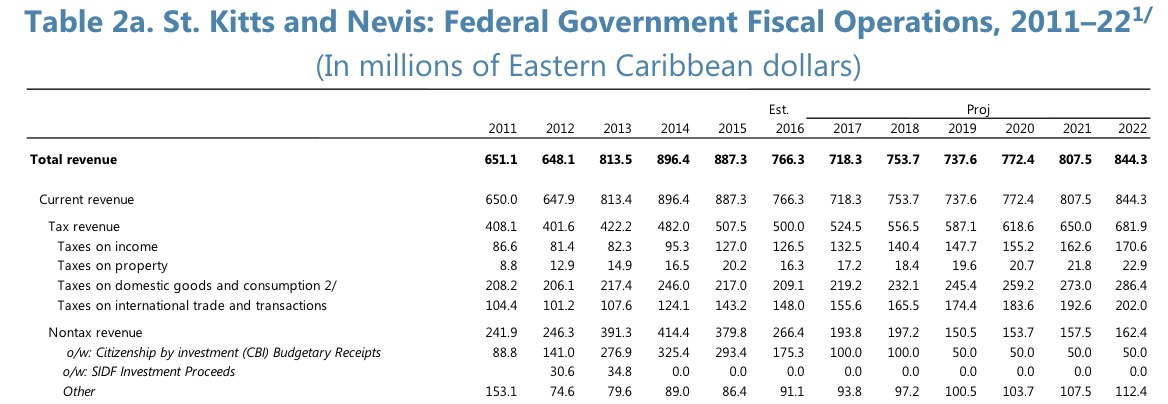

The IMF 2017 report also published on the CBI inflows to SIDF and Budgetary fees from 2012 to 2017 (projections)

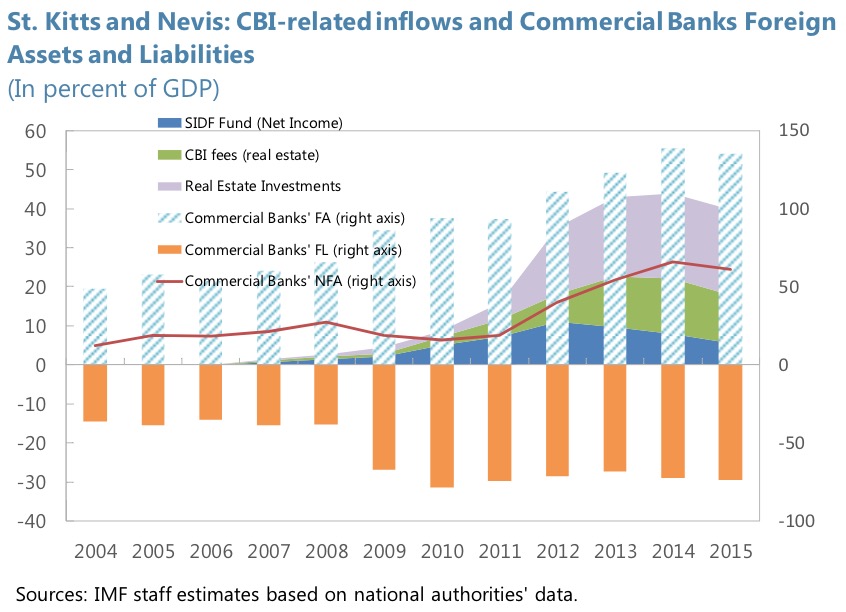

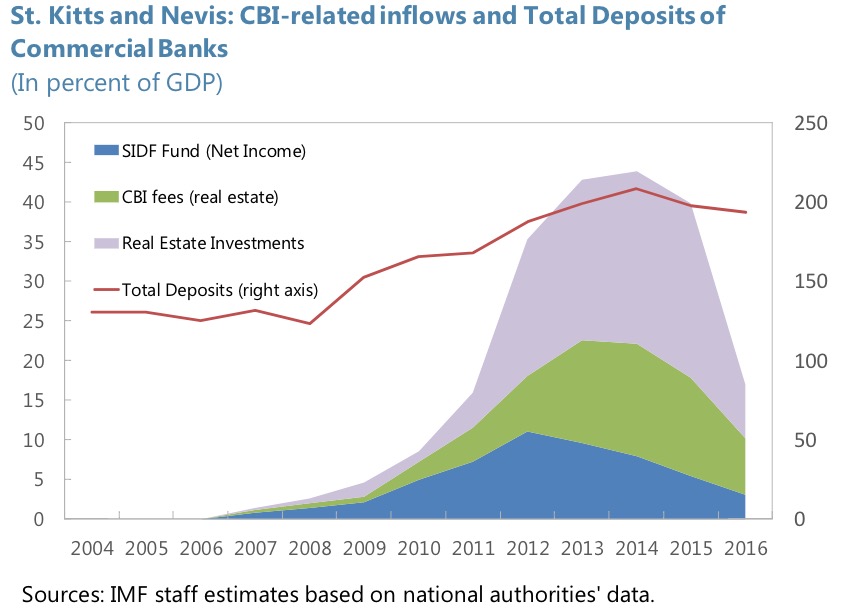

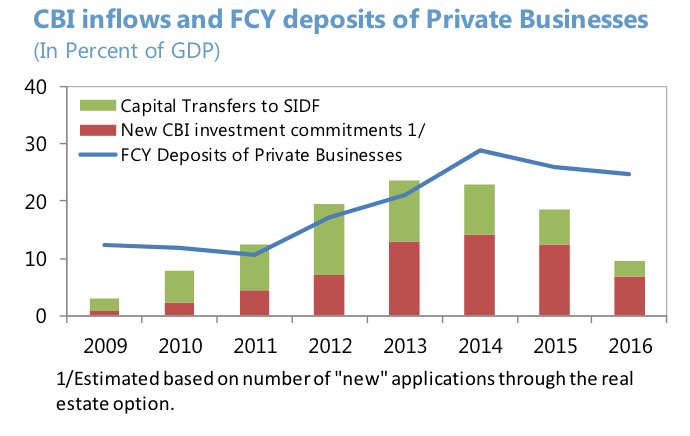

- Over 2010-2016, CBI inflows boosted economic activity in St. Kitts and Nevis, contributing to strengthening macroeconomic performance. The recent slowdown in CBI-related inflows and the ending of the five-year holding period for CBI properties call for close monitoring of the implications for the financial sector through the real estate market and banks’ exposure to real-estate-related activities

- Lower citizenship-by-investment (CBI) inflows have weakened fiscal and external accounts.

- In the Risk Assessment report, IMF says Sharp drop in CBI inflows, Increased competition from regional programs, integrity concerns, high global security risks, and rising political pressure against international migration increase downside risks to CBI inflows, with implications for fiscal, growth and external performance.

- Public debt fell to 66 percent at end-2016, while central government and SIDF deposit buffers rose to 42 percent of GDP.

- The strong macroeconomic performance owes much to the robust Citizenship-by-Investment (CBI) inflows as well as overall prudent macroeconomic policies. However, CBI revenues fell significantly last year and are expected to fall further going forward.

- A sharp CBI slowdown could have a dampening effect on real estate market activity, with most CBI inflows coming through the real-estate option in recent years.

- The inflows through the CBI program have boosted economic activity since 2010 and contributed to the strengthening of the fiscal and external accounts.

- Strong growth in CBI application fees to the budget, which reached a peak at 14 percent of GDP in 2014, with annual average 29 percent of GDP in 2010-16 and a peak of 44 percent in 2014.

- CBI inflows continued in 2015-16, albeit at a much slower pace. Staff estimates suggest that CBI-related resource inflows in 2016 fell to about 60 percent of the 2010-2015 average (a drop of about 20 percentage point of GDP from the previous year).