IMF published Article IV consultation report on Malta on Jan 19, 2018. In the report IMF has indicated

- Malta is enjoying robust economic growth, supported by a rapid expansion of services. The Maltese economy continued to grow at a robust pace. Activity expanded by 7.2 percent y/y in the first three quarters of 2017, following 5.5 percent in 2016.

- Unemployment declined further and inflation increased modestly.

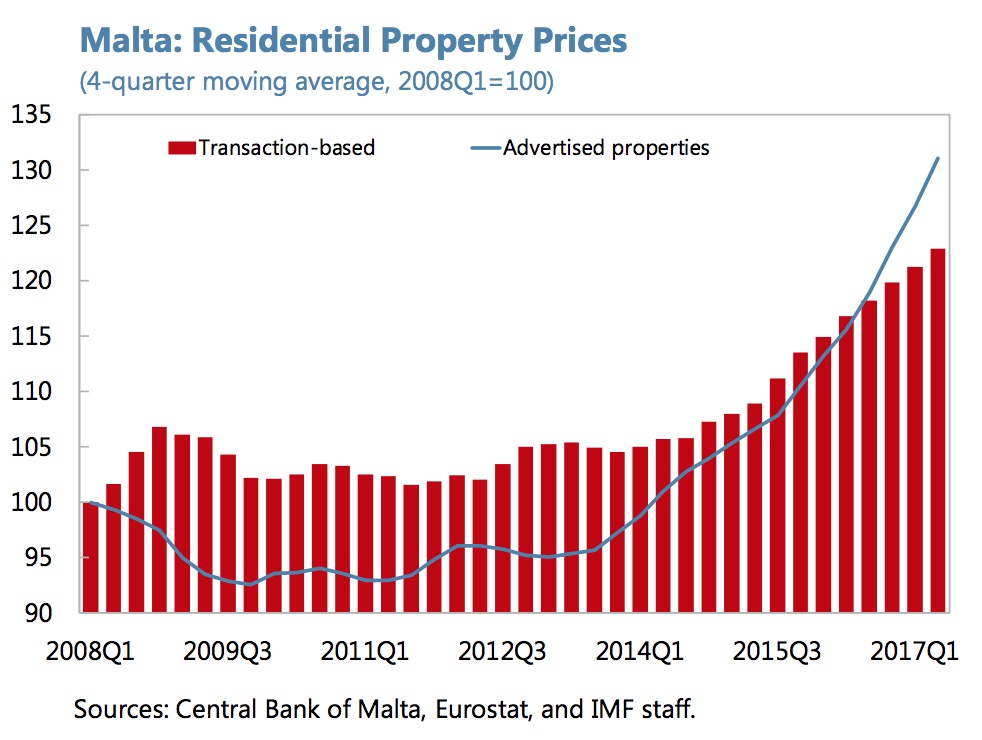

- Property prices continued to increase owing to strong demand. Demand was also fueled by the Individual Investor Program

- Transport congestion has become a concern

- Strong mortgage lending has kept household debt elevated compared to historical average at around 110 percent of gross disposable income.

Malta’s IIP was introduced in 2014. It is a citizenship-by-investment program that allows individuals to acquire citizenship in exchange for major investments in the Maltese economy. Similar programs in other countries have proliferated in recent years and, while they differ in their design and conditions, they all confer citizenship with limited residency requirements and financial contributions to the state (Gold and El- Ashram, 2015).

The IIP is capped at 1800 successful applications, although the government is considering to extend the program. Since its inception, the IIP received about 1000 applications, with most applicants coming from non-EU European and Middle-Eastern countries. The application process is subject to stringent due- diligence by Identity Malta, resulting in a rejection rate of around 20 percent. By October 2017, more than 800 applications were approved.

The cost of the IIP is relatively high compared to other citizenship programs. It requires an investment in financial instruments for a minimum value of €150,000, and in real estate (by purchasing property for a minimum value of €350,000, or leasing for at least €16,000 per annum), with a minimum holding period of five years. Individual applicants must also contribute €650,000, of which 10 percent is retained by Identity Malta and Henley & Partners as fees. The remainder goes to the Treasury’s Consolidated Fund (30 percent), and the National Development and Social Fund (NDSF) (70 percent) to be used for investment projects in areas such as health, education, social housing, and research and innovation (R&I).

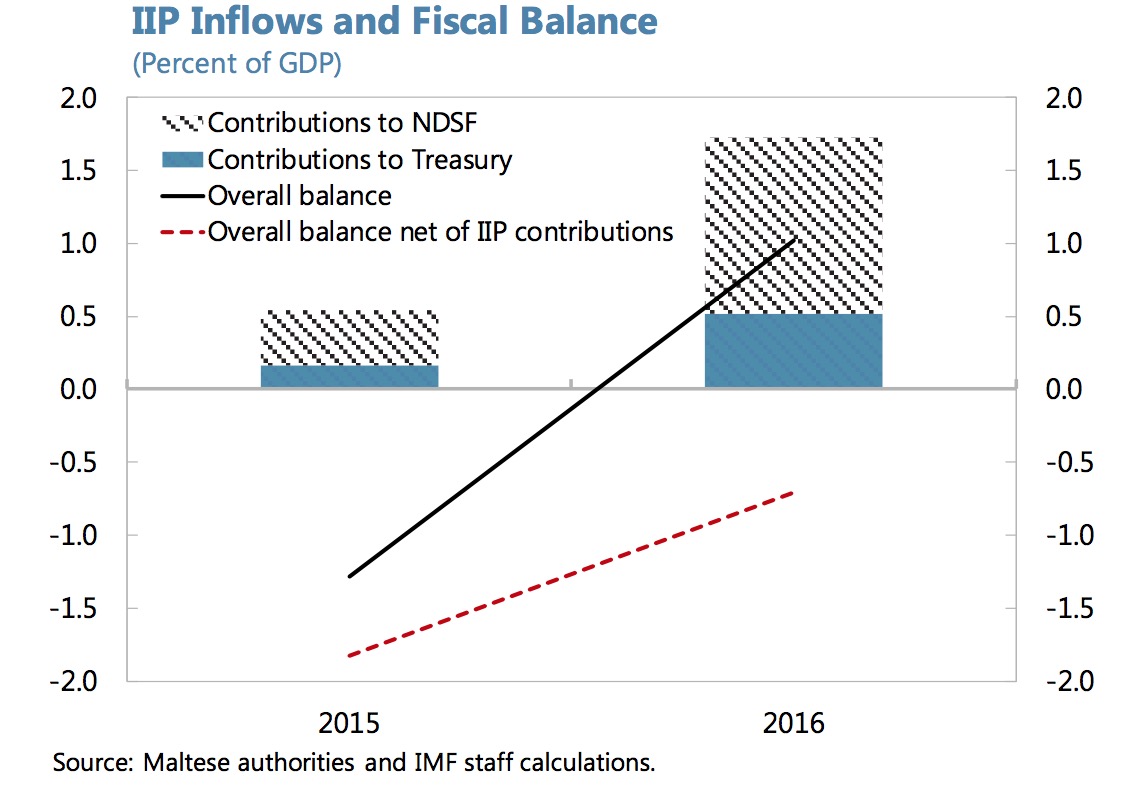

The IIP has generated significant fiscal revenues.

Contributions to the Treasury and the NDSF rose from €50 million in 2015 to €172 million in 2016 (0.5 and 1.7 percent of GDP, respectively). In 2017, staff project these inflows to reach €230 million, roughly equivalent to 2.1 percent of GDP and 5.4 percent of fiscal revenue. As of November 2017, no resources from the NDSF had been committed to specific projects.

Citizenship-by-investment schemes involve potential challenges and risks. Fiscal challenges include achieving a prudent management of the inflows, which might be volatile and unsustainable. Macro-financial risks could be triggered by a rapid influx of housing investment, leading to property market bubbles.

Reputational and money laundering risks may arise if the due-diligence procedure is not sufficiently rigorous.

The fiscal balance is estimated to have registered a surplus for the second consecutive year in 2017, thanks to buoyant revenues—including from Individual Investor Program proceeds— and contained capital expenditure growth. The 2017 current account is estimated to have remained in surplus, driven largely by a sizable balance of services.

IMF has endorsed the following in conclusion of its report

Sustained efforts are needed to safeguard the financial system’s integrity. Robust implementation and effective enforcement of the Anti-Money Laundering framework is critical given the size of Malta’s financial sector, the fast-growing remote gaming activity, and the high demand for the IIP. Continuing strengthening the collaboration between the competent supervisors and regulators, and finalizing the related National Risk Assessment would support these efforts.

Aligning the tax rate on rental income with tax rates on other sources of income, and introducing periodic reviews of the scope and parameters of the IIP, including the minimum real estate investment or leasing values, could curb housing demand pressure.