Grenada Real Estate Market total real estate sales for 2017 were US$50,438,995, slightly above the record high set in 2016, according to C21 Report.

The Total Value of Real Estate Purchases by Non-Grenadians, declined from US$10 million in 2016 to US$2.6 million in 2017, falling by 74%..

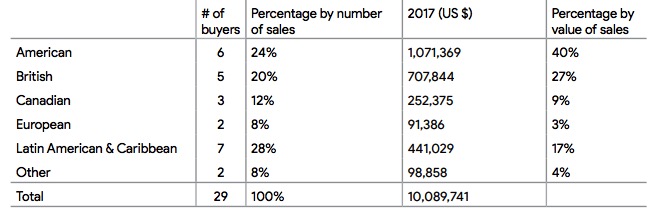

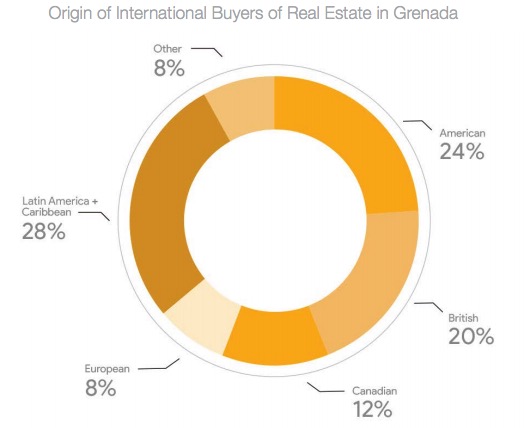

The number of non-Grenadian purchasers buying property in Grenada, and the value of those transactions, declined significantly in 2017. The contribution of international buyers to Grenada’s real estate market was minor, and primarily focused in the parish of St. George and St. David. Purchases clustered at the lower end of the value spectrum, primarily inexpensive vacant lands. The Total Value of Real Estate Purchases by Non-Grenadians, declined from US$10 million in 2016 to US$2.6 million in 2017, falling by 74%. There has been a significant shift in the source markets for international buyers. In 2015, British buyers accounted for 81% of the value of real estate purchases by foreign buyers. That number has contracted to 27%. American buyers have increased from 8% in 2016 to 24%. It is important to note that these are very small data sets, and as such are easily skewed.

The average sales value was US$106,514. Of note is the reality that the average transaction value for non-Grenadian purchasers is only moderately greater than the average sales value for the overall market, which is US$ 83,897.

Grenada currently has around 400 listings on Airbnb alone contributing to tourism market.

The most popular locations to purchase property by foreigners are St. George, St. David and Carriacou

It is unclear what caused the precipitous decline in foreign buyers. Some possible contributors include:

- Competition from Grenada’s Citizenship by Investment Program (as well as other regional programs). The projects being built though the Grenada CBI program are highly desirable, achieving a new level of luxury and offering attractive returns on investment.

- A punitive property transfer tax on foreign buyers applied to the purchase and sale prices of properties. While this is not a new tax, it is becoming increasing out of touch with global real estate norms.

- The loss of the British buyer. The malaise caused by Brexit and the weakened British pound have undermined the appetite of the UK market for luxury lifestyle purchases.

Citizenship by Investment projects will be coming on-stream in 2018. This will almost certainly have a positive impact on Grenada’s tourism and real estate market. The Grenada economy is growing. A signicant contribution is being made by the luxury real estate being built through the Citizenship by Investment (CBI) program.

Construction is underway at several luxury resort developments; including, The Pointe at Petite Calivigny, Silver Sands, Kiwana Bay, and Mt. Cinnamon. When completed, all of these properties will rank among the highest levels of luxury available in Grenada, with some on-par with the highest standards of tourism anywhere in the world.

The Citizenship by Investment Unit of Grenada has approved 16 real estate projects under citizenship scheme. A minimum of USD 350,000 property investment required to qualify for citizenship.

In the 2018 Budget speech, the Prime Minister of Grenada revealed the following

Real estate activity in 2017 is on track to match the high level set in 2016. Sales through November of 2017 totalled more than $100 million. Sales activity was dominated by Grenadian purchasers, especially young families, making up more than 85% of the total transaction values, with average sales values of $213,000 (a combination of vacant land and homes).

The Grenada tourism and real estate markets are starting to see the positive impacts of the increased marketing and PR emanating from the CBI program and the projects noted above. We anticipate this will only increase as these projects move from construction into operation. Thus far, the greatest impact the CBI program has had on local real estate is in the demand it is placing on prime development sites in the south of the island. There were several such acquisitions in 2017 and several more pending for 2018.

Carriacou attracted the greatest number of non-Grenadians to its shores, with 25%

Summary of details of some of the major private sector projects under implementation from 2016 and investment projects for 2017 are as follows:

- The Point at Petite Calivigny Resort – Phase I of this project started in January of 2016, with an estimated investment cost of $162.0 million, with $24.0 million already invested. The project currently employs over 80 construction workers and is expected to employ 50 persons upon completion. Phase I is expected to be completed by March of 2018.

- KAWANA Bay – The redevelopment of Flamboyant Hotel into a 4.5 star Kimpton branded hotel commenced in January this year. The project cost is estimated at $125.0 mil- lion, with $31.0 million invested to date, creating construction employment for approximately 60 persons. Phase I of the project is expected to be completed by August 2018, adding 41 rooms to Grenada’s current room stock. The second phase commences in January 2018, with 52 new rooms and creating employment for 250 to 300 construction workers. Over 162 permanent jobs are expected to be created on completion of the project.

- Levera Development – This tourism development project has invested to date more than $10.0 million. Construction employment has been created for over 30 per- sons in St. Patrick and surrounding areas.

- Solamente Villa Ltd. – The estimated cost of this luxury villa resort is $27.0 million. Operations recently commenced under Phase I of the Project, with 75 to 100 construction workers employed, and 25 permanent employees, once fully operational.

- Reese Investments – This commercial complex of 150 hotel rooms with full amenities, entertainment facilities and a business centre, represents an investment of US$30 million, and estimated employment of about 100.

- Hideaway True Blue – This $21 million condo- minimum development will provide 42 fully furnished units. Construction has already begun and is scheduled to be key- ready by July, 2018. This phase provides at least 50 construction jobs, with about 7-10 full-time jobs in the operational phase, and about 30 indirect jobs being generated out of this enterprise.

- Clarkes Court Marina – In 2017, an additional investment of $2.0 million was made, bringing the total in- vestment to over $45.0 million. Thirty- ve permanent jobs have been created to date. Phases II and III of this major project will see the development of additional accommodation facilities.

- Serenite Estates Inc. – The , construction of the 52-apartment tourism facility started in 2017, at an estimated cost of $9.0 million, of which $1.5 million have been expend- ed thus far. Construction employment has been created for 60 persons, with 25 permanent employees upon completion.

- Silver Sands Resort Development – This major luxury resort project is nearing completion at an investment cost of USD 65 million, of which XCD77.0 million already spent in 2017. It is expected to be opened in March 2018 with about 180 full time employees. There are currently 230 construction workers and 30 internal staff. Over the past two and a half years, the project has created employment for over 400 Grenadians.

- Laluna Beach Resort and Villas – The second phase of the upgrade and expansion will start in January 2018, with the construction of 13 new residences, a restaurant, and art center with 3 studios for an artist residency programme. The investment is valued at $64.0 million. Employment during con- struction is expected to be over 100, with 45 full time employ- ees when the project becomes operational.

Source/Credit: C21 Report