Knight Frank has published 2018 wealth report on Global wealth and also published some insights into the citizesnhip by investment schemes

Citizenship for sale

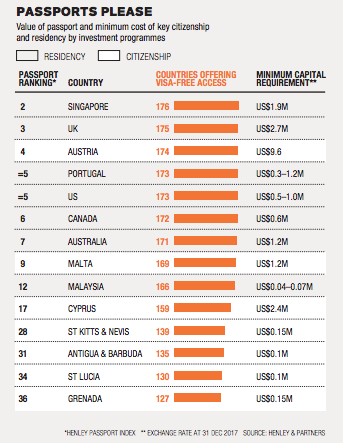

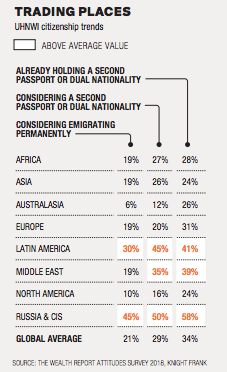

This trend is reflected in the growth in demand for second passports and residencies. Data from our Attitudes Survey reveals that 34% of UHNWIs already hold a second passport and 29% are planning to purchase one, while 21% are considering emigrating permanently. The result has been a bidding war, as more countries seeking new sources of revenue try to encourage foreign direct investment in return for citizenship.

Some, including the UK, require a significant level of long-term financial commitment; but there are others with less onerous programmes or which are relaxing their requirements. In the Caribbean, for example, several islands have recently slashed the level of investment required by as much as 50%, or linked citizenship to one-off contributions to hurricane relief or economic development funds.

Safe havens

As the sector matures it will provide a major source of future revenue for countries that lack alternative exports – but, as we discuss overleaf, reputational risks are rising too. Less drastic than a change of residence but perhaps similarly effective, at least for now, is to place money in a country outside the CRS net. Switzerland, for example, has delayed the exchange of information with Middle East countries. BIS data confirms that financial non-bank deposits from Saudi Arabia and the United Arab Emirates into Switzerland rose by 44% and 53% respectively over the past three years, running counter to the trend of an overall fall in global deposits held there. This urge for privacy is also steering flows within the CRS countries, with those offering high standards of data security emerging as favoured investment hubs. It is one thing for data to be disclosed to your home government; it is quite another for it to be sold on to third parties with questionable motives. In its current guise, the CRS may encourage investment into property, at least in the short term. Under the existing rules, there is no requirement to report on property assets unless they are mortgaged. Some commentators have linked the growth in price and demand for Hong Kong property in the months leading up to September 2017 to a rush by mainland investors to prepare themselves ahead of CRS reporting. An increase in exposure to the US may be another consequence.

There are no reliable figures available on the amount of capital coming into the most notable non-CRS signatory, but portfolio managers and fiduciaries put it in the hundreds of billions of dollars. This looks realistic in the light of data from the National Association of Realtors, which confirms that foreign buyer activity increased by over US$50 billion year on year in the 12 months to March 2017. As money becomes more mobile and scrutiny of offshore wealth increases, governments are trying to encourage money back onshore. Tax amnesties have raised tens of billions of dollars for governments across the world. From Indonesia to Italy, France and Fiji, at least US$66 billion has been clawed back. The tension between the growing globalisation of wealth and the desire for governments to provide controls will not easily be resolved, in large part because governments are conflicted in their desire to protect existing tax revenues at the same time as attracting new sources of wealth.

Expert commentaries

A panel of leading industry experts assesses the risks and opportunities posed by the growth of citizenship by investment schemes, and the implications of international transparency drives.

Only as strong as their weakest link Global families – and their businesses – today span countries and even continents. Acquiring alternative residence or citizenship is a means of participating in and moving through this interconnected world with greater ease, and we expect that the value of this kind of mobility and access will only increase as the tendency towards isolationist, immigration-hostile policies becomes more prominent worldwide. Programmes are only as strong as their weakest link, and the most appealing are those with the most stringent processes in place. The only programmes worth considering are those that uphold high standards of due diligence and are free of corruption. These are the ones that draw credible, wealthy, and talented individuals with valuable business networks and entrepreneurial expertise to a country, enriching its social and economic capital.

Dr Christian Kälin Group Chairman, Henley & Partners

Only the best regulation is acceptable

Citizenship and residency by investment programmes are big business: currently, the industry is worth an estimated US$2 billion each year. However, it is beginning to draw concern and criticism. Some take issue with the very notion of nationality as a commodity, with prospective customers choosing their new country based on price or “features” such as ease of travel, purchasing passports “off the shelf” and, aside from buying a property or handing over a fixed sum investment, making little real contribution to the host country. Concern is also growing that the acquisition of a new nationality may be a vehicle to avoid FATCA, the CRS and various other international efforts to stem tax evasion. If this idea gathers momentum, it could potentially create problems for the countries involved. Furthermore, there is the fear of terrorists being found to have travelled on a new passport before committing an atrocity. It is not hard to imagine how this could lead to governments being reluctant to accept “purchased” passports, restricting their use or denying access to those who bear them. Clearly, there is great – and growing – demand. As the market matures, it would therefore be appropriate for governments to adopt stringent criteria in order to guard against such passports being acquired for improper or criminal purposes.

Joseph A Field Partner, Withersworldwide

Revenues must be spent responsibly

For microstates with small economies, the benefits of citizenship and residency by investment programmes can be substantial. In certain Caribbean islands, programme revenues account for up to a third of GDP. The potential profitability of the channel has led to investment migration policies spreading, allowing small economies to formalise and scale up previous informal offerings of residency and citizenship. Nonetheless, the overall effectiveness of the programmes depends on how funds are used. They may be spent responsibly to support long-term economic growth, along with educational opportunities, medical facilities, pensions and other forms of social support, but such assurances are typically not written into the policies themselves. Whether or not the programmes deliver the benefits they promise is ultimately a question of implementation and oversight.

Dr Kristin Surak SOAS University of London

Data security risks

Perhaps unsurprisingly, the advent of the electronic exchange of financial information is pushing the issue of cyber-security to the top of the agenda. The unprecedented amount of financial data being shared between governments is also raising concerns about personal security. So individuals must give careful consideration to how, where and in what form they hold their wealth. Wealthy individuals also need to consider the impact of reporting on the structures they currently use. For example, they may want to reduce the number of beneficial owners to lower reporting requirements. In addition, individuals will need to look again at the locations where their wealth is held, in the light of the strength of official data security rules and the extent of the risk of data breaches from poorly administered systems.

– Filippo Noseda Partner, Mishcon de Reya

Rules need to evolve rapidly

Transparency rules are a relatively new trend and those that have been introduced to date are generally not well drafted. Financial institutions are now having to disclose information about clients’ assets and interests in structures, while often not understanding the requirements in full. There is a real risk of duplication and inconsistency. So far, we have not seen clients venturing into unregulated activity in order to escape disclosure. Those with the understanding – and the appetite for risk – may decide to invest in Bitcoin, say, but this will typically be for financial rather than tax or disclosure reasons. They might then also benefit from greater confidentiality under current rules, although, in the light of the recent popularity of Bitcoin, this benefit may be short lived as we would expect transparency regulations to catch up with investment trends.

– Alexander Erskine Senior Associate, Taylor Wessing

Technology will be required

There is a dichotomy at the heart of the global drive for transparency. Although the exchange of information will simplify dealings with cross-border tax authorities, there remains a real reluctance to provide governments with information due to a basic lack of trust. The growth of new technology infrastructure platforms like Blockchain could help alleviate fears and facilitate exchange. Blockchain provides the most secure infrastructure for housing this type of data, allowing access to a fixed number of parties and ensuring that any actual or attempted changes to data are embedded in the audit trail. Moving forward, many families may not trust the transparency demanded by global CRS, but they can trust Blockchain to record an unalterable audit trail. In a twist on the old saying, “In God we trust, but all others must start using Blockchain.”

David Friedman CEO, LifeChain

Source/Credit: knightfrank.com