A number of HNWI population due to increased globalisation and increased mobility are interested in migrating to a more wealthy nation, offering plethora of opportunities. Many HNWIs invest in second passport and hold it their investment portfolio. A

High net worth individuals are usually millionaires while Ultra high net worth individuals is a term used to describe individuals with net assets above 50 million. s a result of investment migration, the wealth shifts from one country to another country.

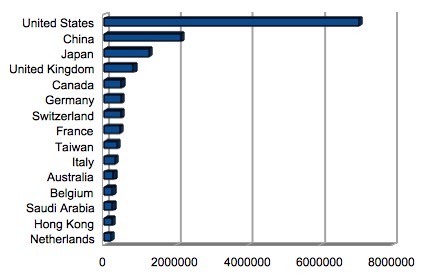

- Millionaires: At the end of 2017, there were estimated to be just over 15 million US$ millionaires or high-net-worth individual (HNWIs) in the world. The United States had the highest number of HNWIs (5,047,000) of any country, while New York City had the most HNWIs (393,500) among cities.

- Billionaires: As of 2018, there are over 2,700 U.S. dollar billionaires worldwide, with a combined wealth of over US$9.2 trillion

An interesting insight of HNWIs migration presented by the Alternative Capital Group in a video below, specifically talks about migration of these millionaires are caused by push and pull factors

Trends in High-net worth Investing

- The movement of millionaires around the world

- The factors that push and pull people towards these programs

- The difference between traditional immigration and investment migration

Top 3 Countries for Millionaire Migrants

Australia, Canada and United States are the prime destinations receiving the largest number of millionaire migrants. Reason for this is these three countries are stable politically and economically, permit free and open culture, abundant resources and infrastructure and much more desirable. Quite commonly, people with these passports are welcome anywhere.

- Canada

- United States

- Australia

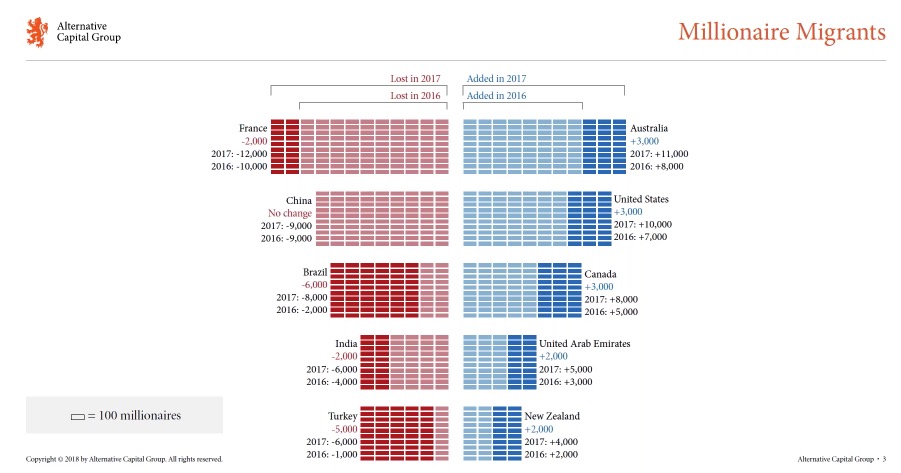

Tens of thousands of citizens of France, China, Brazil are moving abroad for various reasons

France has a long standing tradition of taxing wealthy individuals. Due to attacks last year, security is a major concern and safety is a basic need for a comfortable living. France has pushed away rich immigrants who would have otherwise flocked to the french capital of the world. Tax flight of the rich is not a myth. People who are very rich, retired or who aren’t tied to particular location, do change their tax residency at a high rate based on tax differentials.

China: Why are China’s rich are leaving? Chinese want better education for children, distressed with pollution problems and concerned about food safety in their country. Real estate is expensive compared to many other countries. Most of the chinese who were thinking about leaving, have already left now. The country with the newest millionaires are ‘bleeding’.

As far as Brazil, India and Turkey are concerned, it is more about more of about policies and national taxation and corruption.

Super-rich Indians shifted base. India witnessed the second largest millionaire outflow after China with 7000 HNWIs changing their domicile in 2017

Push and Pull Factors

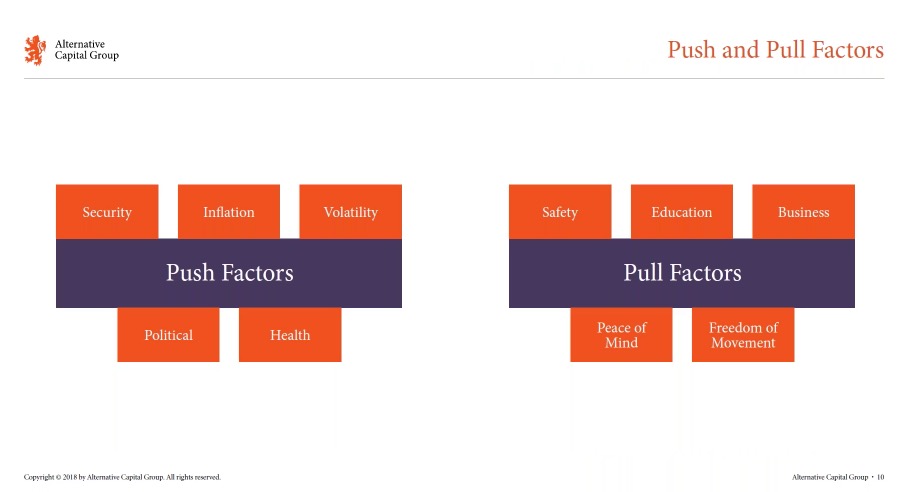

Why these HNWI migrants are changing their homes? A stable political system is one of the biggest push factor for wealthy migrants. Security, volatility and inflation are the biggest risks faced by migrants, who dont want to lose their wealth by these factors. Volatility of currencies could be destructive. Turkish lira took a nosedive since 2014 showed no signs of stopping.

As far as freedom of movement is concerned, a persons movements overseas should never be limited or complicated, be it for leisure or work.

- Push factors: Security, Inflation Volatility, Political, Health

- Pull Factors: Safety, Education, Business, Peace of Mind, Freedom of movement

A complete video the trends can be viewed here below

https://altcapgroup.wistia.com/medias/wubnjkak54

Source/ Credit: Alternative Capital Group

Photo credit: https://www.flickr.com/photos/jasondirks/